Annual inflation in 2022 was 10.5%, but not all components rose by double digits.

Source: ONS.

Annual inflation, as measured by the Consumer Prices Index (CPI), was 10.5% in 2022 against 5.4% in 2021. The official CPI calculator, the Office for National Statistics (ONS), says that the last time inflation was as high was in 1981. But what drove the inflation indices to four-decade highs last year? As is often the case, a simple economic question does not lead to a straightforward answer.

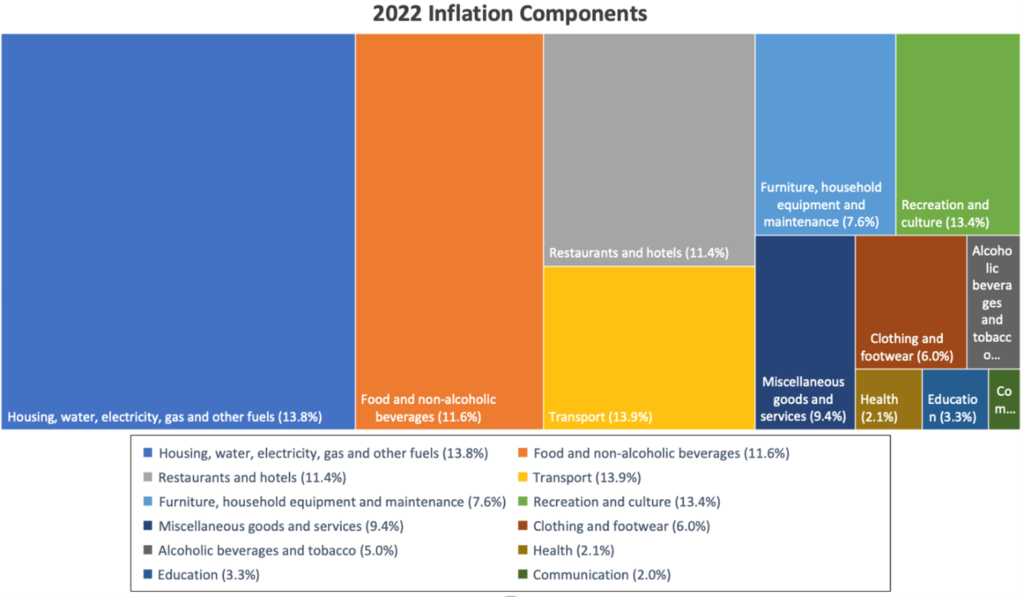

Hierarchy graph above offers a visual response:

- The ONS CPI inflation ‘basket’ contains 12 categories, each with different weights (see figures in brackets) based on typical household expenditure. In 2022, the second largest category of spending, Housing, water, electricity, gas and other fuels, recorded an increase of 26.6%. Unsurprisingly, the star performer was gas prices, which rose 128.9% across 2022. That alone was worth a 1.8% rise in the CPI. Electricity prices jumped by 65.4%, adding another 1.3% to the CPI.

- The next largest contributor to inflation, with a slightly smaller weighting in the basket, was Food and non-alcoholic beverages, which rose by 16.8% over the year. This category’s inflation rose for 17 months, now at 1977 levels (-0.6% in Jul ’21), per ONS. It accounted for 1.95% of CPI inflation.

- In 2022, the category with the largest weighting in the CPI basket, Transport, played a less significant role in terms of overall inflation (0.9% on the CPI) than it did last year. Over the year, the category’s inflation was 6.5%. In June, annual transport inflation was nearly 15%, driven by the rise in petrol and diesel prices. As these fell back, so too did the transport rate.

- The category with the lowest inflation (2.0%) was also the one with the second lowest basket weighting – Communications – so did little to counter the sharp rises elsewhere.

The two main causes of 2022 inflation: food & gas prices. Expected to drop in 2023 as prices stabilize, wholesale gas prices have fallen. Consensus for annual CPI to end around 5%, still requires building value erosion into long-term financial plans.

Can we help you navigate through inflation?

If you need help with your long-term financial planning needs, please contact us on 01444 716946 or on 01273 963656 or alternatively email us.